springfield mo city sales tax rate

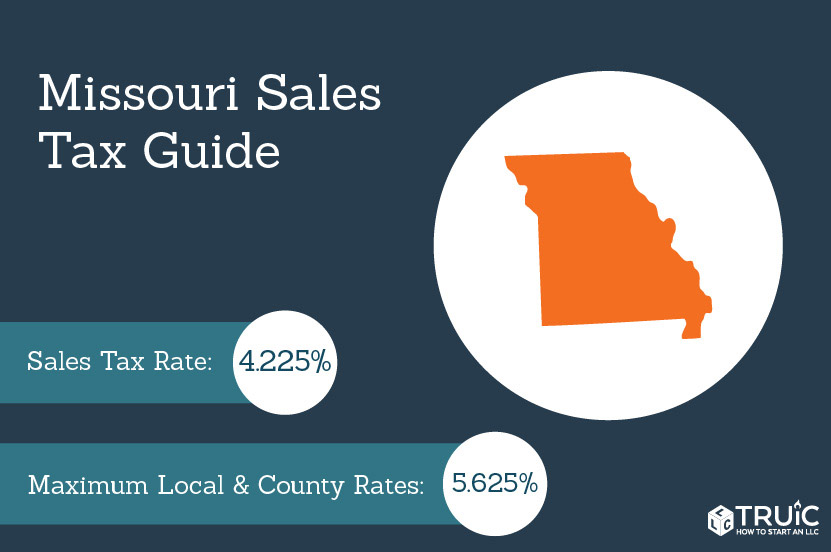

1 State Sales tax is 423. Did South Dakota v.

Sales Taxes In The United States Wikiwand

Sales Tax and Use Tax Rate of Zip Code 65806 is located in Springfield City Greene County Missouri State.

. The Missouri sales tax rate is currently. Sales Tax and Use Tax Rate of Zip Code 65802 is located in Springfield City Greene County Missouri State. The Springfield sales tax rate is.

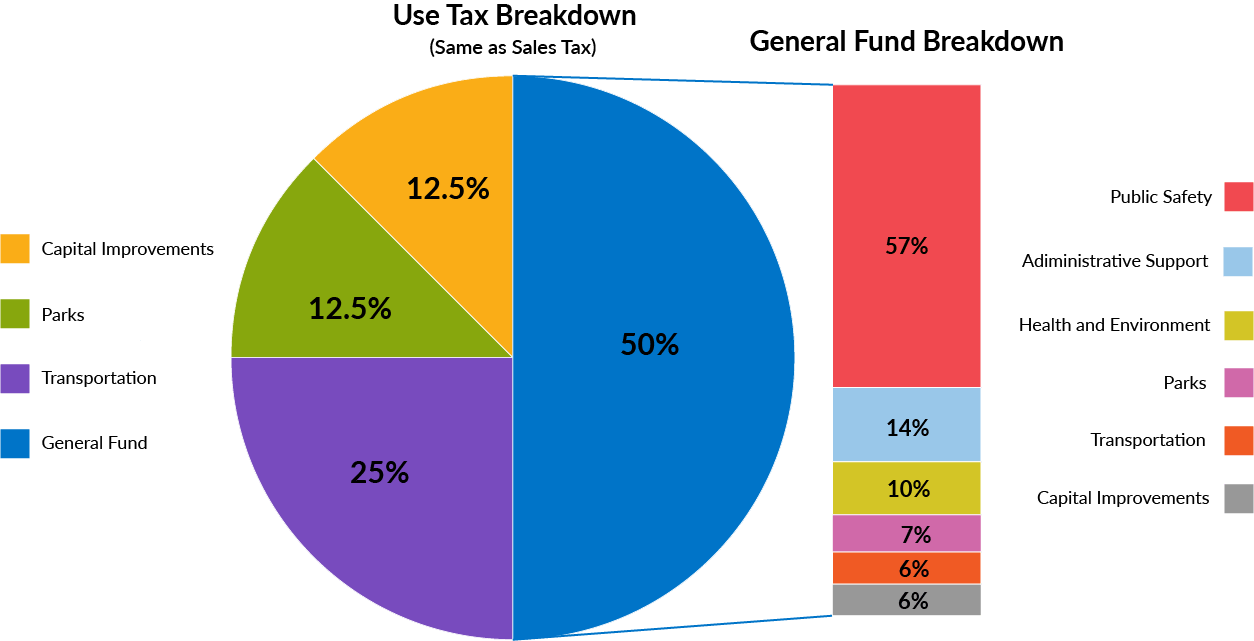

Springfields sales tax is 81 which includes the following breakdown. 1 State Sales tax is 423. 1 State Sales tax is 423.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. The base sales tax rate is 81. Wayfair Inc affect Missouri.

The Springfield City Code Chapter 70 Article V requires hotels motels and tourist courts to pay a tax equal to 5 of the gross rental receipts paid by transient guests for sleeping. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the. A proof gallon is a gallon of.

3 rows The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax. Sales Tax and Use Tax Rate of Zip Code 65810 is located in Springfield City Greene County Missouri State. Raytown MO Sales Tax Rate.

The tax continues to be 27 cents for 100 of assessed value. The 2018 United States Supreme. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175.

You can find more tax rates. 4 rows Springfield MO Sales Tax Rate The current total local sales tax rate in Springfield MO. Sales Tax and Use Tax Rate of Zip Code 65890 is located in Springfield City Greene County Missouri State.

The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and. What is the sales tax rate in the City of Springfield. Springfield in Missouri has a tax rate of 76 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Springfield totaling 337.

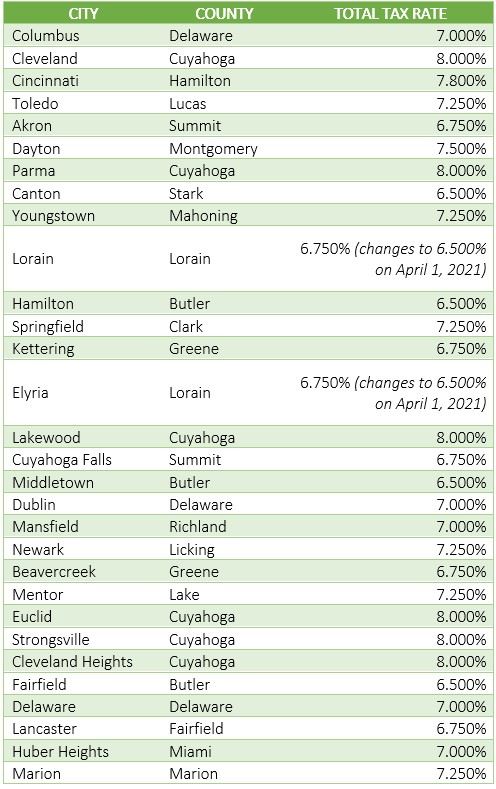

What it is The combined rate of state and local sales tax within Springfield city limits. 17 rows City Sales Tax City County and State taxes Knoxville TN. This includes state sales tax of 4225 the city sales tax of.

Sales Tax and Use Tax Rate of Zip Code 65807 is located in Springfield City Greene County Missouri State. The County sales tax rate is. 1 State Sales tax is 423.

Over the past year there have been 97 local sales tax rate changes in Missouri. Ad Find Out Sales Tax Rates For Free. Saint Charles MO Sales Tax Rate.

Fast Easy Tax Solutions. 1 State Sales tax is 423.

Missouri Car Sales Tax Calculator

Ohio Sales Tax Guide For Businesses

Nebraska Sales Tax Rates By City County 2022

Why Are Income Taxes So High In The Usa Quora

Sales Taxes In The United States Wikiwand

Sales Tax On Grocery Items Taxjar

Louisiana Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand

Use Tax Web Page City Of Columbia Missouri

Taxes Springfield Regional Economic Partnership

Why Are Income Taxes So High In The Usa Quora

St 2007 04 Sales And Use Tax Sales Of Motor Vehicles To Nonresidents Of Ohio Issued August 2007 Revised March 2009 Revised October 2011 Revised September 2013 Department Of Taxation

Financial Reports Springfield Mo Official Website

Springfield Mo Word Pictures Expectations Teachable Moments

Missouri Sales Tax Small Business Guide Truic