what is a fit deduction on paycheck

FIT is applied to taxpayers for all of their taxable income during the year. People also ask what is fit deduction on my paycheck.

Understanding Your Paycheck Credit Com

Federal income tax deduction can be abbreviated FIT deduction.

. Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits. How much federal tax should be deducted from my paycheck. For the employee above with 1500 in weekly pay the calculation is 1500 x 765.

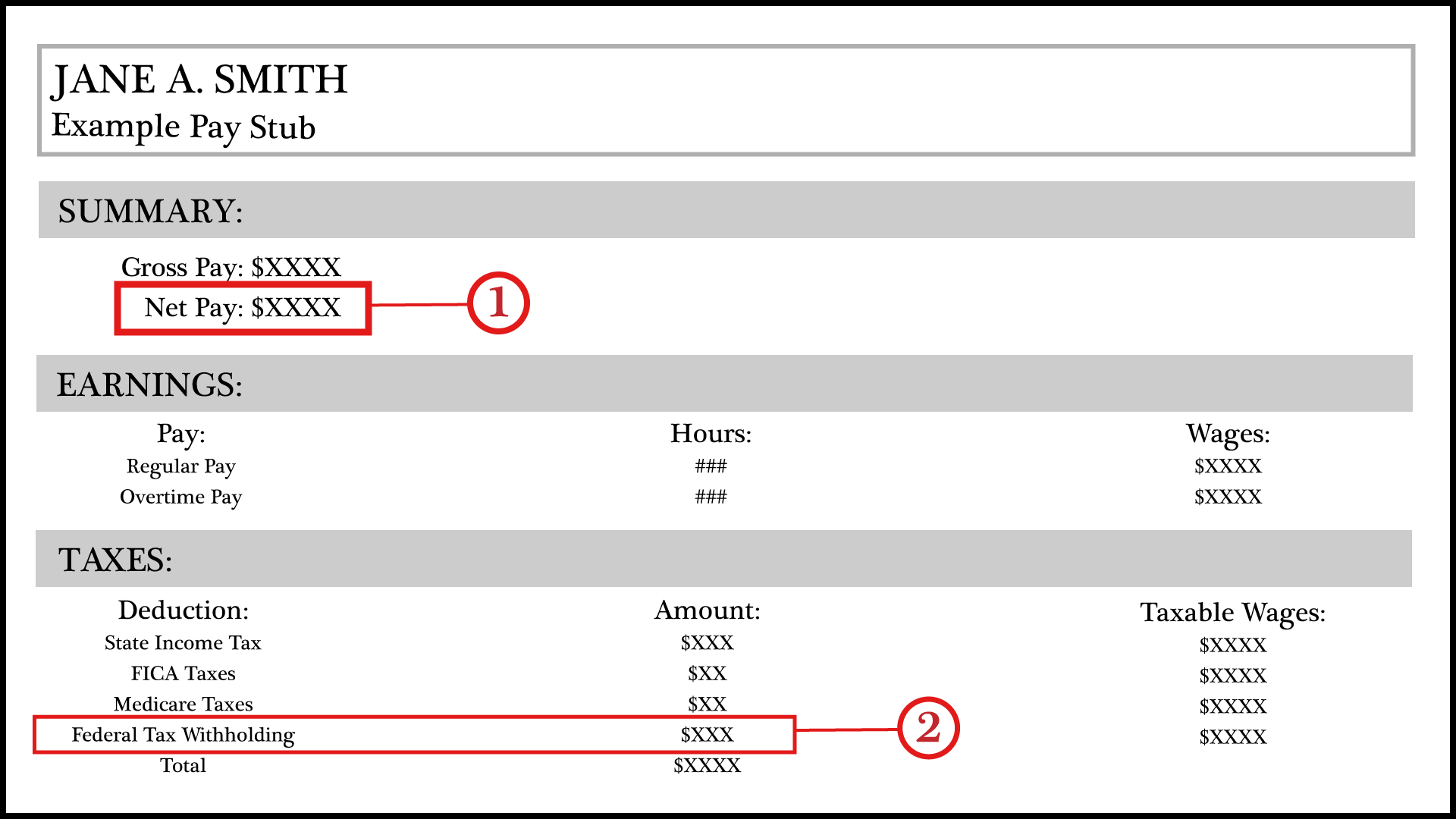

FITW stands for federal income tax withholding Its the amount your employer deducts from your earnings each pay period and remits to the IRS on your behalf. These items go on your income tax return as payments against your income tax liability FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. FIT deductions are typically one of the largest deductions on an earnings statement.

In any payroll there is always a certain portion paid out toward an employees income eg. Multiply one withholding allowance for your payroll period see Table 5 below by the number of allowances the employee claims. Employers withhold or deduct some of their employees pay in order to cover.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. FIT is applied to taxpayers for all of their taxable income during the year. Youre not required to match this deduction.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. 0765 for a total of 11475. They are all different taxes withheld.

Some entities such as corporations and trusts are able to modify their rate through deductions and credits. Some are income tax withholding. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

In the United States federal income tax is determined by the Internal Revenue Service. This amount is based on information provided on the employees W-4. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income.

The rate is not the same for every taxpayer. The amount of FICA tax is 153 of the employees gross pay. The standard deduction is the portion of your income the IRS allows to be deducted from your taxable income.

Starting with the pay period in which an individuals earnings exceed 200000 you must begin deducting 09 from his or her wages until the end of the year. FIT on a pay stub stands for federal income tax. Federal Unemployment Tax Act FUTA is another type of tax withheld.

Payroll taxes and income tax. Regular Wages and a certain portion that is deducted from an employees income. Federal taxes are the taxes withheld from employee paychecks.

It ensures only people with. FIT is the amount required by law for employers to withhold from wages to pay taxes. Federal income tax deduction refers to the amount of federal income taxes withheld from an employees paycheck each pay cycle.

The employee can adjust the FIT deduction by filing a W-4 however paying below true tax liability may result in a fine when filing taxes. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Additional Medical Tax also applies to certain levels of railroad retirement compensation and self-employment income.

FICA FICA stands for Federal Insurance Contribution Act. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. FIT deductions are typically one of the largest deductions on an earnings statement.

Deductions on your paycheck is a fancy way of describing the amount that an employee pays to cover employment expenses mandatory and otherwise. The FIT deduction on your paycheck represents the federal tax withholding from your gross income. The amount of money you.

FIT stands for federal income tax. This tax includes two separate. Half of the total 765 is withheld from the employees paycheck and half is paid by the employer.

Federal Income Tax FIT and Federal Insurance Contributions Act FICA. FIT Fed Income Tax SIT State Income Tax. FIT deductions are typically one of the largest deductions on an earnings statement.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Other groups such as charitable organizations can apply for tax-exempt status. Ariel SkelleyBlend ImagesGetty Images.

This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. FIT deductions are typically one of the largest deductions on an earnings statement. However FUTA is paid solely by employers.

How do you calculate fit tax. These taxes fall into two groups. Employees generally receive a paycheck along with additional information an earnings statement explaining how the amount on the check was calculated.

For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. FIT represents thededuction from your gross salary to pay federal withholding also known as income taxes.

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Different Types Of Payroll Deductions Gusto

What Are Payroll Deductions Article

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Payroll Payroll Federal Income Tax Business

Payroll Deduction Authorization Form Template Ad Sponsored Deduction Payroll Authorization Template F Payroll Deduction Templates Printable Free

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

What Are Pay Stub Deduction Codes Form Pros

What Are Payroll Deductions Article

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Employee Life Insurance Employee Benefit Benefit Program Business Insurance

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

Understanding Your Pay Statement Office Of Human Resources

Understanding Your Paycheck Paycheck Understanding Yourself Understanding

What Everything On Your Pay Stub Means Money

Organisation Pay Stub Template Word Apple Pages Pdf Template Net Payroll Template Templates Free Organization